What Is Arbitrage?

In economics and finance, arbitrage is an act of generating a profit from price differences of the same asset in different markets. Arbitrage usually consists of a set of trades that correspond to each other but are executed in different directions in order to turn the spread into a profit.

In short, arbitrage is the simultaneous purchase and sale of the same asset in different markets in order to profit from temporary differences in the asset's listed price.

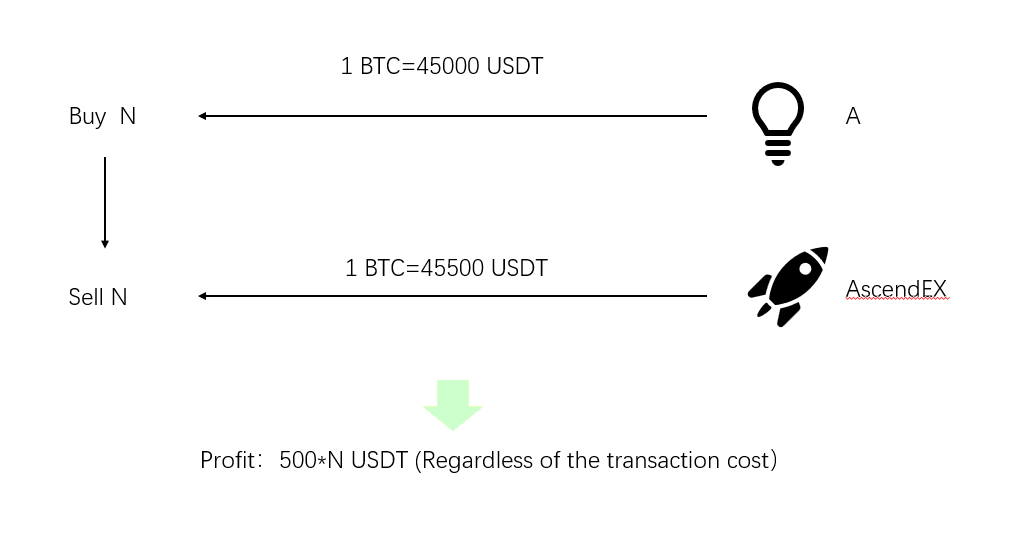

Take a crypto transaction as an example, assume that BTC is priced at 45,500 USDT on AscendEX, while it’s quoted at 45,000 USDT on the platform A. Traders can buy N BTC on the platform A and then withdraw the asset to AscendEX to sell it. Without considering the transaction cost, traders can earn (45,500-45,000) * N USDT from the trade.

Arbitrage trading is a trading option with which investors are almost guaranteed to make a profit. With low risks, competitions in the arbitrage trading market are fierce, and arbitrage profits largely depend on the transaction volume and speed of each trade due to the tiny profit from a single trade. In other words, traders need to invest a lot of money in order to earn large profits. Plus, due to transparent arbitrage trading strategies, fierce competition and fleeting profit opportunities, arbitrage trading also requires a high transaction speed. Therefore, most of arbitrage trading strategies are usually adopted by large financial institutions, and transactions are not manually executed, but rather by algorithmic trading.

Conditions for Arbitrage

In theory, the price difference of the same asset in different markets should be zero. In effect, led by a variety of practical factors, different markets price specific assets differently. Price differences of assets create conditions for arbitrage. To profit from arbitrage trading, arbitrageurs are required to find these price discrepancies and be able to trade quickly.

Please see below to understand the common conditions for utilizing arbitrage strategies. When one or multiple following conditions are met, it means opportunities are available for arbitrage trading.

1. The price of the same asset differs in different markets

As we mentioned above about crypto arbitrage trading, if the price of the same assets differs in different markets, it means there are opportunities for arbitrage trading.

2. A big price gap between two assets with the same or similar valuation

This scenario is usually seen amongst similar crop varieties (such as soft wheat and hard wheat), as well as in the areas of raw materials and finished products, such as soybeans and soybean oil.

3. A huge difference between the current price of an asset with a known future price and its discounted price at a risk-free interest rate.

This scenario is often seen amongst assets that incur warehousing fees, such as agricultural produce, whose prices are greatly affected by warehousing costs over time.

Scenarios for the Application of Arbitrage Trading Strategies

Generally, arbitrage opportunities exist in stock markets, forex markets, commodity markets, derivatives markets, crypto markets and so on. Please see below for the commonly seen scenarios for the application of arbitrage trading strategies.

1. Commodity price spread arbitrage

Commodity price spread arbitrage is commonly practiced and is achieved based on the price gap of the same commodity in different markets. For example, there are always huge price gaps between fruit-producing areas and non-fruit-producing areas. As long as fruit prices (such as apples) in non-producing areas remain higher than those of producing areas after risk costs involving transportation, warehousing and others are deducted, arbitrage trading can be carried out by procuring fruits from producing areas to selling them in non-producing areas.

2. Stock price spread arbitrage

Stock price spread arbitrage is the process of leveraging the price spread of the same stock in different exchange markets to make a profit. The most common scenario is cross-platform arbitrage. For example, when stock is listed on both the Chicago Mercantile Exchange and the New York Stock Exchange. If the stock spread between the two markets is greater than its trading cost, it means that there is an opportunity for spread arbitrage. In addition, the common strategies adopted for spread arbitrage on the stocks of listed companies also include merger arbitrage.

3. Forex spread arbitrage

Forex spread arbitrage is the act of trading the same currency in two different forex markets to profit from the price spread. For instance, assume that you can exchange 1 dollar for 100 yen on exchange A, while the exchange rate on exchange B is 1 dollar for 85 yen. Arbitrageurs can sell yen and buy dollars on the exchange B, and then sell dollars and buy yen on the exchange A to achieve arbitrage.

Other common arbitrage scenarios include: labor cost arbitrage, ETF arbitrage, derivatives arbitrage, etc.

Crypto Arbitrage Strategies

Arbitrage is also common in crypto markets. The following are popular crypto arbitrage strategies:

1. Trading platform arbitrage

Trading platform arbitrage means traders can buy crypto assets on one trading platform and sell them on another trading platform to profit from the price gap of the assets between the two trading platforms.

Please note: cross-platform arbitrage needs to consider the speed of transaction and execution, whether the spread profit can cover the transaction cost, and the strength of platforms (whether the platform can provide strong enough liquidity to ensure the completion of arbitrage trading), and other factors.

2. Funding rate arbitrage

Funding rate arbitrage means using the futures and spot hedging of long and short orders to earn funding fees. Given a high funding rate (that is, there is a large difference between the perpetual contract price and the spot price), traders can purchase crypto while at the same time opening a short position in the perpetual futures contract market to hedge spot price fluctuations, to earn funding fees during the holding period. Common funding rate arbitrage strategies also include perpetual futures contracts and leverage hedging arbitrage.

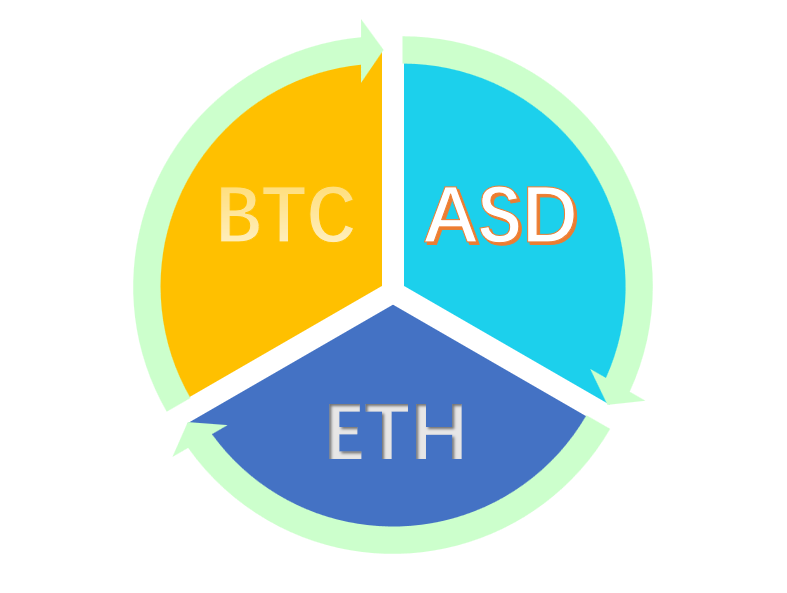

3. Triangular arbitrage

Triangular arbitrage refers to profiting from simultaneously buying and selling three different cryptocurrencies to exploit inconsistencies between their exchange rates on the same exchange. For example, traders can buy ETH using ASD, then buy BTC using ETH and buy back ASD using BTC to profit from their rate spread.

Arbitrage Risks

In traditional economics, arbitrage is also described as “trading without a chance of loss”, or trading to make a risk-free profit at a low cost, meaning, arbitrage trading can be risk-free in theory. However, in practice, most of the arbitrage trading strategies are "statistical arbitrage" strategies (the probability of profit is greater than the probability of loss), and arbitrage trading still presents some risks.

Arbitrage trading risks include: 1. Price change risk. If there are sharp fluctuations in the value of the underlying asset, huge changes in economic fundamentals and other factors weaken price spread dynamics, traders may suffer losses. 2. Transaction execution risk. Arbitrage trading relies on high transaction speeds. If the transaction execution speed is too slow, spread arbitrage opportunities may disappear before the transaction is completed. 3. Transaction risk. Some assets require the trading portfolio leveraging different trading directions to be executed simultaneously in arbitrage trading. If the two transactions cannot be done at the same time with the best price, it will lead to price changes in the market. For example, slippage errors will narrow profits of traders. 4. Counterparty risk. Arbitrageurs may also face risks such as default by the counterparty and inability to pay funds. 5. Liquidity risk. When there is not enough liquidity to support traders to complete arbitrage, traders will face liquidity risk.

Arbitrage Implications

Arbitrage trading can cause the prices of the same commodity remain consistent in different markets. As long as there are no restrictions on transactions and the cost of buying, selling and holding is low enough (there is room to profit), arbitrage will occur, leading to no long-term price deviations in different markets. In addition, arbitrage trading will bring the prices of different currencies back to the level that caters to ordinary traders.