I. What is the funding rate?

The funding rate is a special mechanism in the cryptocurrency perpetual futures market that encourages periodic payments (i.e., funding fees) between long and short traders, aligning the price of the perpetual futures with the index price. When the funding rate is positive, buyers (longs) pay sellers (shorts). When the funding rate is negative, shorts pay longs.

Note: Funding payments are fees paid by perpetual futures traders, and AscendEX only facilitates the cash flows exchanged between long- and short-position holders without charging any service fees.

II. The Origin of Funding Rate

In traditional futures contracts, as the delivery date approaches, the futures price naturally converges with the spot price and eventually reaches parity. However, perpetual futures in the crypto space, which does not have a delivery date, adopts a funding rate mechanism to narrow the price difference between the perpetual futures market and the corresponding spot market.

The funding rate mechanism in perpetual futures is equivalent to the settlement mechanism in traditional futures contract markets. Both mechanisms aim to constrain the futures price, pegging it to the spot price, and achieve price consistency between the two markets, avoiding price manipulation and other divergences.

III. Funding Rate Calculation

The funding rate and funding payments (settled in USDT): When the funding rate is positive, longs (futures buyers) pay funding payments to shorts (futures sellers). When the funding rate is negative, shorts pay longs. When the funding rate is 0, neither longs nor shorts need to make payments.

The formula for calculating the funding payments you receive or make is as follows:

Funding fee = Funding rate x Index price x Position size

Funding rate = Premium/Index price

Notes:

1. Funding payments are settled every 8 hours at specific settlement times: UTC 0:00, UTC 8:00, UTC 16:00. And funding payments is settled every 4 hours for several tokens. Details can be found on the futures trading page. If you don't have a position at the settlement time, you don't need to pay or receive funding payments.

2. The funding rate is updated every 60 seconds, and users can check real-time and previous funding rates on AscendEX.

3. The upper limit of the funding rate for BTC futures is 3%, and the lower limit is -3%. For other cryptocurrencies, the upper limit of the funding rate is 5%, and the lower limit is -5%.

4. Funding fees will be calculated based on the position value and the current funding rate. If the funding rate is positive, long positions will be charged funding fees, while short positions will receive funding fees. And funding fees will be sent to users' futures account. The opposite applies if the funding rate is negative. Funding fees will be deducted from the user's position margin.

IV. How to Check the Funding Rate

1. Real-time funding rate on AscendEX:

https://ascendex.com/en/futures/feerate/current

2. Funding rate history on AscendEX:

https://ascendex.com/en/futures/feerate/history

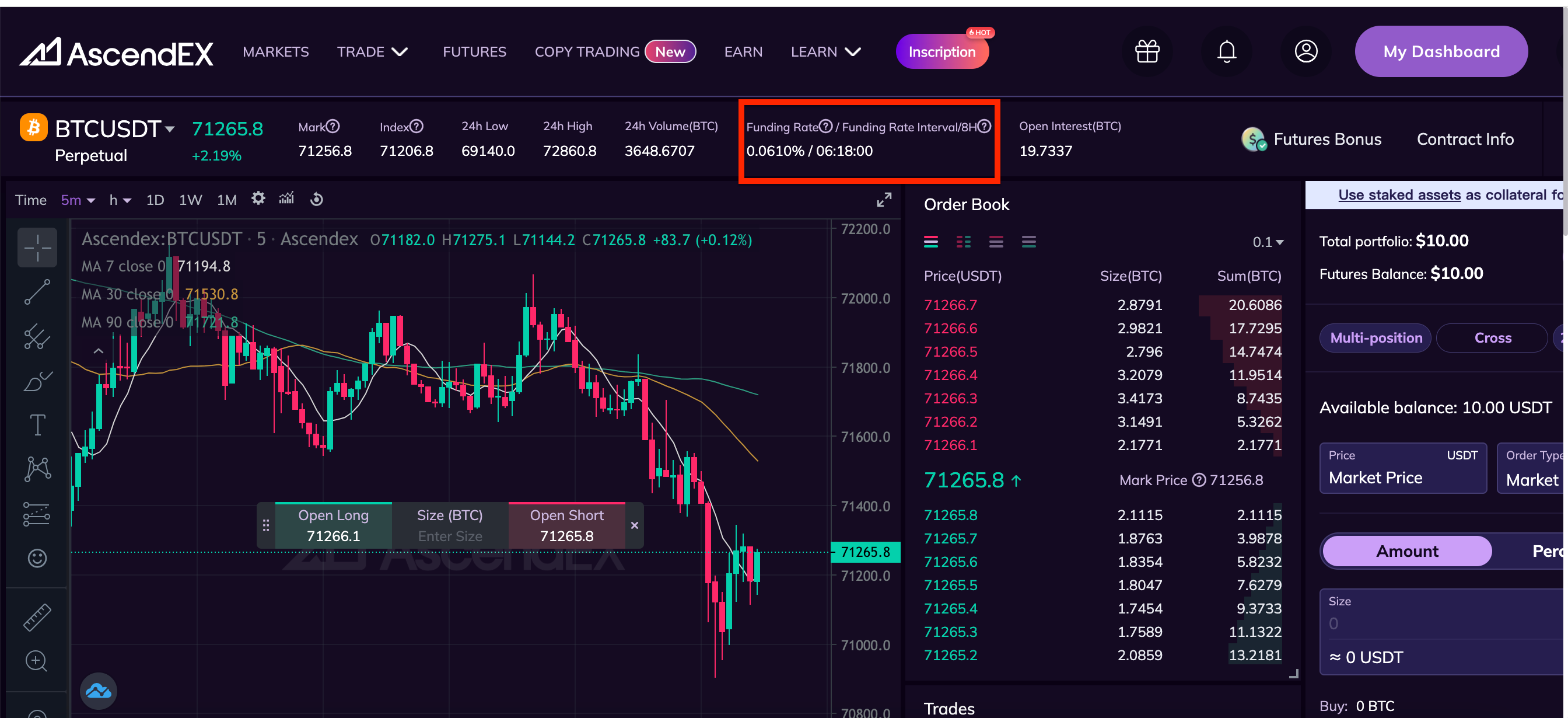

3. Funding rate on AscendEX’s perpetual futures trading page:

V. Funding Rate Arbitrage

In theory, if a cryptocurrency has a funding rate that remains consistently high for a prolonged period, investors have the opportunity to gain profits through the funding rate mechanism.

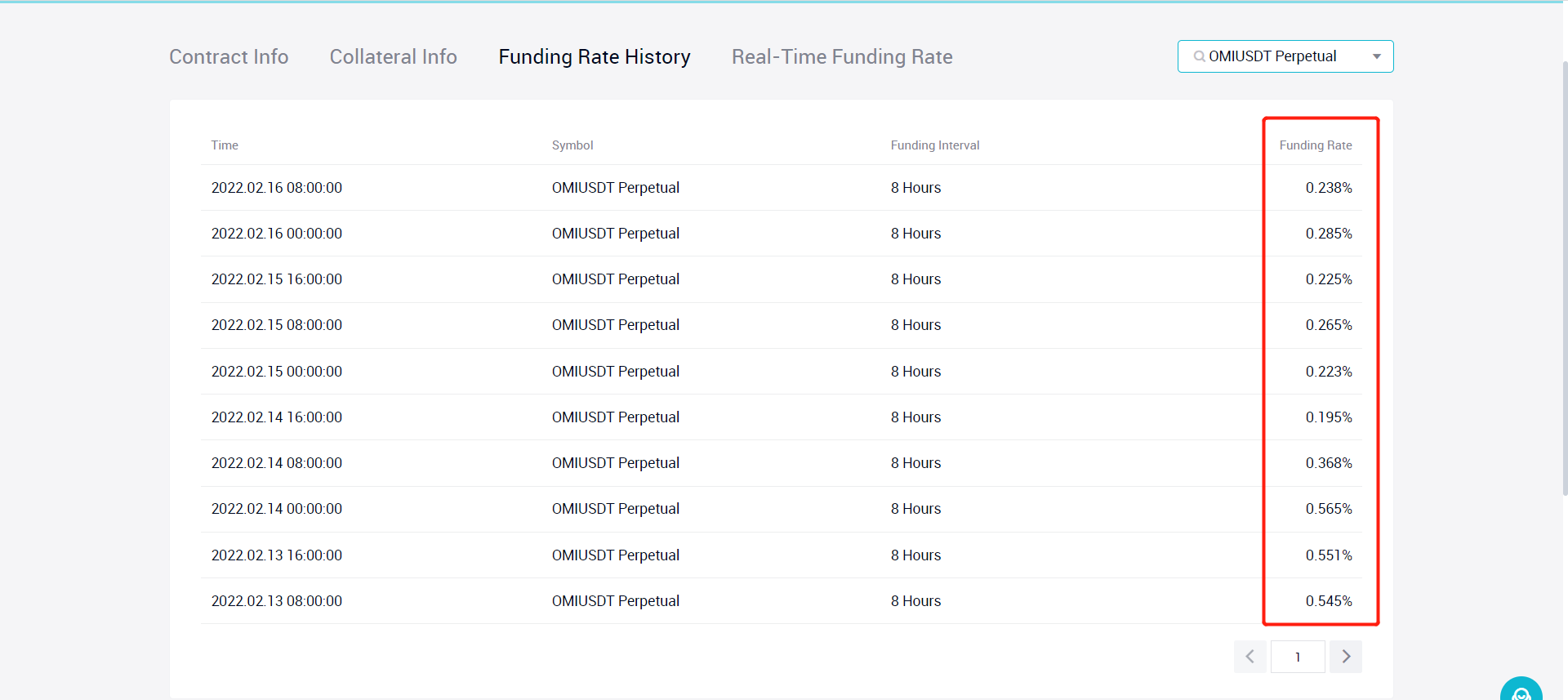

Let's take the example of the OMI perpetual futures. Assuming the funding rate for the OMI perpetual futures remains at a consistently high positive value, it means that in theory, users holding OMI short positions can earn profits from funding rates.

However, it's important to note that the above strategy does not consider the risk of price volatility. While it's theoretically possible for investors to earn from funding rates by holding a short position on OMI, if the market moves contrary to their expectations and the OMI price increases, their position will incur losses. To hedge this risk, investors would need to buy an equivalent amount of OMI in the spot market or go long on OMI in margin trading.

1. Core strategy of funding rate

Based on the example above, the key aspects of mastering the funding rate arbitrage strategy are as follows:

Key 1: Selection of cryptocurrency

When selecting a cryptocurrency, choose one with a high funding rate that can last for a long time. You can check real-time and previous funding rates for all futures assets on AscendEX.

Key 2: Holding positions in spot/margin market

To mitigate the risk of price volatility, create positions in both the spot/margin market and the perpetual futures market with equal value but opposite directions. This is crucial for long-term profitability.

2. Step-by-Step Guide

Method 1: Spot-Futures Arbitrage

a. Buy the desired cryptocurrency in the spot market;

b. Simultaneously open a short position (sell) on the cryptocurrency in the perpetual futures market with an equal value;

c. Close the short futures position at the opportune time based on your profit target and sell the spot cryptocurrency to realize the profit.

Let’s use the OMI perpetual futures as an example. Suppose the funding rate is currently 0.422% and is expected to be 0.566% for the next funding payment. At this time, buy spot OMI worth 10,000 USDT and simultaneously open a short position on the OMI perpetual futures with an equal value of 10,000 USDT. Then, when the next funding arrives, the expected profit from a single payment would be 10,000 USDT * 0.556% = 55.6 USDT. Assuming the OMI funding rate remains at this level for a week, the expected profit over the week would be 55.6 * 3 * 7 = 1,167.6 USDT. (Note: This example doesn't consider the changes in position value due to price fluctuations during the holding period for simplicity.)

Method 2: Margin-Futures Arbitrage

a. When the funding rate is positive and |funding rate| > margin loan interest rate + trading fee rate, short positions in the futures market can receive funding fees from long positions. Therefore, open a short position on the perpetual futures and simultaneously buy an equivalent value of the cryptocurrency in the margin market.

b. When the funding rate is negative and |funding rate| > margin loan interest rate + trading fee rate, long positions in the futures market can receive funding fees from short positions. Thus, open a long position on the perpetual futures and simultaneously sell an equivalent value of the cryptocurrency in the margin market.

Note: Since margin trading involves interest rates when borrowing assets, users implementing the funding rate arbitrage strategy should consider the potential impact of the interest rates. In a scenario where the futures’ funding rate remains unchanged, it's important to minimize interest rates and trading fees to maximize profits.

Risk Reminder: Exercise caution in selecting cryptocurrencies, allocate funds sensibly, and manage trading risks when engaging in funding rate arbitrage. Beware of the risk of liquidation due to insufficient market depth or abnormal price fluctuations.