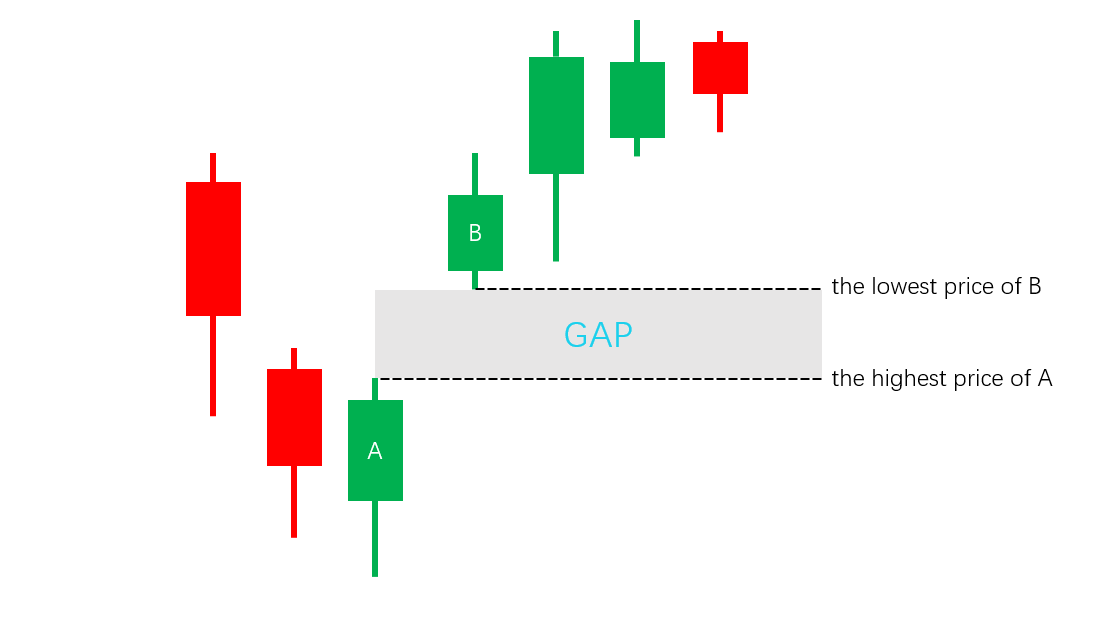

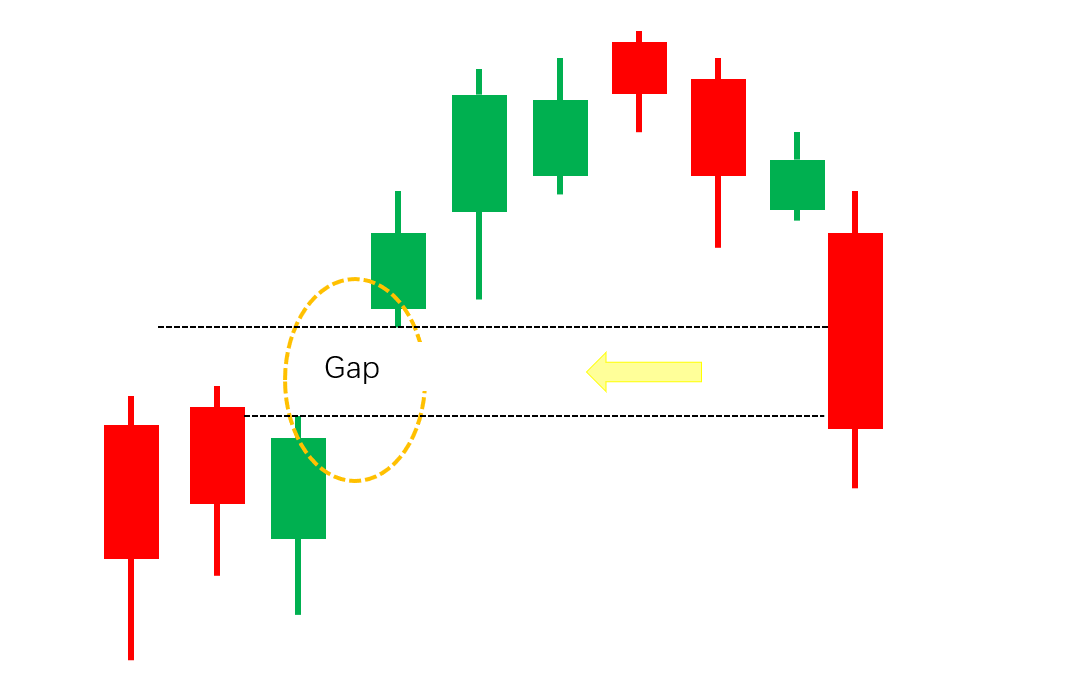

On a financial chart, a gap is a break, or a price zone created when the price of an asset makes a sharp move up or down with no trading occurring in between due to rapid price movements of the asset.

On the following chart, the gray zone formed between candle A and candle B is called a gap, where no trading took place.

What Does a Gap Mean?

A gap sometimes reflects market sentiments. The appearance of a gap indicates no trading occurs during the time the price gap exists, meaning no traders are willing to sell or buy at the current price level. From the perspective of market trends, a gap means there is strong buying or selling due to underlying fundamental or technical factors.

From a theoretical point of view, gaps consist of two types: Gap up and gap down.

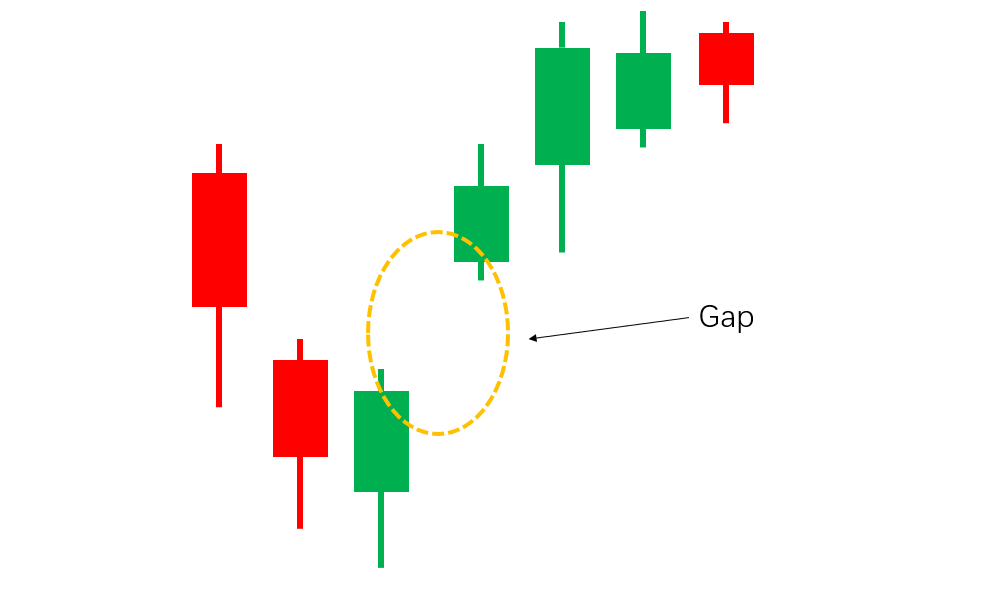

Gap Up

If the price bounces higher than the closing price of the previous candle, it is called a gap up.

A gap up signals the odds of a continued price advance are high. If the gap sees indicators of a breakaway gap, it indicates a strong increase in buying demand. From the technical perspective, if a gap up leads to a breakout or a downside trend, it must have much stronger strength than a long white candle formed without a gap up. The space created by the gap up will form a support line when the market declines.

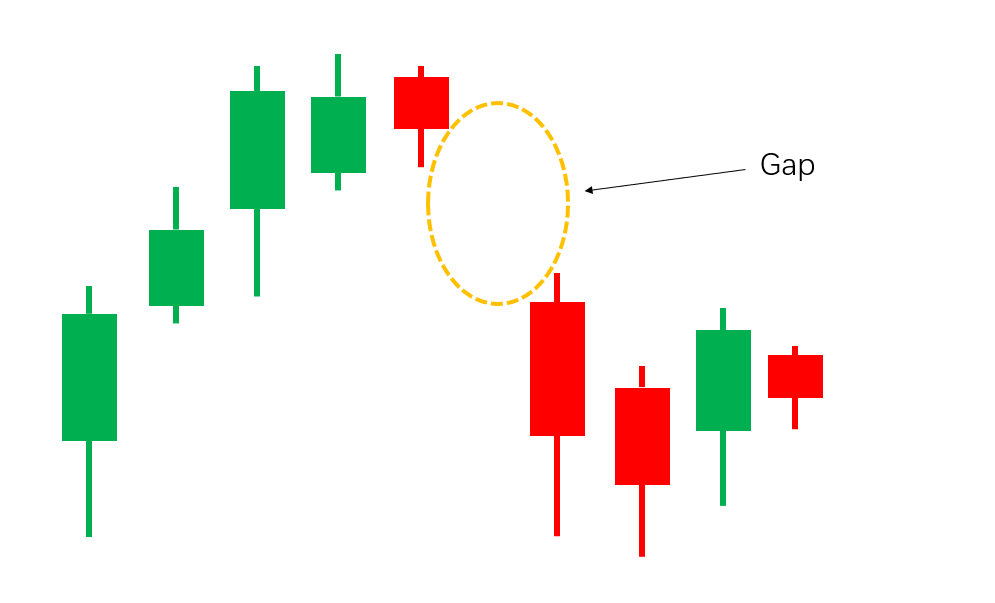

Gap Down

If the price falls lower than the closing price of the previous candle, it is called a gap down.

A gap down signals a possible price decline in the market, indicating there is strong selling pressure in the market due to negative market sentiment. From the technical perspective, if a gap down leads to a breakout or a upside trend, it must have much stronger strength than a long white candle formed without a gap up. The space created by the gap down will form a zone of resistance when the market rallies.

Overall, a gap up or a gap down is usually regarded a signal that the market is about to rally or decline. However, traders need to capitalize on other analytical tools or indicators to confirm the effectiveness of a gap while executing a trade, paying close attention to the market trend.

Four Types of Gaps

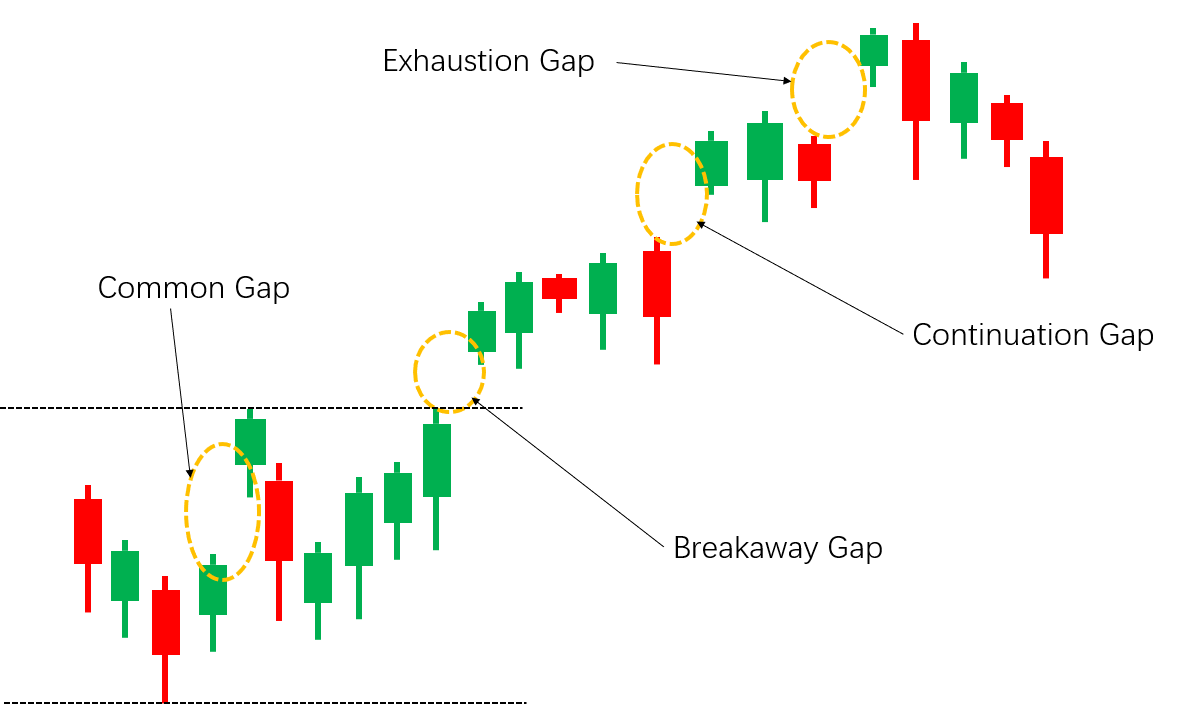

Gaps can be classified into four groups: common gap, breakaway gap, runaway gap or continuation gap and exhaustion gap. Please see below for details:

1. Common Gap

A common gap is frequently observed during consolidations or in markets with low volumes. It occurs mainly due to uninterested market participants, quiet markets and small trade orders. By contrast with other types of gaps, common gaps provide no real analytical insight and are mostly neglected by market technicians.

2. Breakaway Gap

A breakaway gap refers to an upward or downward gap during a support or a resistance breakout. The emergence of the gap is normally a signal of action of market forces, which can be usually taken as a reference for a buying or selling.

A breakaway gap is generally accompanied by a rise in volume. An upward breakaway gap means the odds of a further price advance are high and it can provide support once it’s not filled. Conversely, a downward breakaway gap means the odds of a further price decline are high, and it creates a resistance once it’s not filled.

3. Runaway/Continuation Gap

A continuation gap is also known as a runaway gap. It occurs during the development of a robust upward or downward movement. The gap will accelerate the development of the current trend and will not be filled quickly. A runaway gap is always accompanied by a rise in trading volume.

4. Exhaustion Gap

An exhaustion gap occurs near the end of a price pattern. As it is accompanied by a rally in volume, the gap can be filled quickly. It’s a final gap in the direction of the trend that is usually filled very quickly. If the gap is filled, weak market sentiments will follow. An exhaustion gap very often causes a reversal of the trend.

Please see below chart for detailed features of the four types of gaps:

| Type | Position | Trend | Features |

|---|---|---|---|

| Common Gap | During consolidation | No trend is confirmed |

|

| Breakaway Gap | At the end of a price pattern | Beginning of an uptrend or downtrend |

|

| Runaway Gap | During the development of a robust movement | In an uptrend or downtrend |

|

| Exhaustion Gap | At the end of a primary trend | A reversal of the trend |

|

Due to different positions and patterns, the four types of gaps have different analytical insights. In general, breakaway gaps, runaway gaps and exhaustion gaps are worth paying attention to due to their significant implications. If they are not filled, they all signal prices are facing strong momentum.

Additionally, there are other gaps that have no major implications about further price movements besides common gaps, including gaps that happen in the traditional stock market and are caused by factors other than the exclusion of rights & dividends or a capital increase/reduction. Traders do not need to pay special attention to these types of gaps.

Gap Fill

A gap fill is the process where a gap in asset prices has been filled due to a reversal of the market trend, meaning the price has moved back to the original pre-gap level.

As the following chart shows, the price gap above resistance can't sustain the price and moves back into the prior trading range.

In technical analysis, the gap theory is widely concerned by traders, not only because gaps of different types can assist traders in analyzing market trends, but also the gap-fill is a popular trading strategy.

As mentioned above, a gap up or a gap down will form a support or resistance level for the price. The corresponding gap fill shows: if there is a market reversal and the gap is filled (a support or resistance breakout), it means market forces are turning bearish. Therefore, traders need to pay attention to the signal of a market reversal.

Theoretically, any gap can be filled, because people believe the appearance of gaps is a result of impulsive actions of investors in the price range. Once they calm down, a gap fill will occur.

However, it should be noted that not all gaps are filled, and not all fills are effective fills. What is an effective gap fill? It’s generally considered that if the market’s close rises above the gap or breaks through the gap, or the market’s close falls below the gap or breaks down through the gap, it means a failed or ineffective gap fill.

No matter what type the gap is, it basically provides the information or signals described below: 1. A possible market trend 2. A signal of strong momentum 3. A position to observe support and resistance 4. Information about gap size and trend intensity. Understanding a gap can help traders gain a better grasp of the market’s dynamics. In trading, it can assist traders in identifying the price movement trends that coincide with gaps along with other indicators, thus determining their own trading strategies.