Hedging is a financial term. A hedge is an investment that is made with the intention of reducing the risk of adverse price movements of an asset.

Take Bitcoin miners as an example for a better understanding of the concept. Affected by mining machine’s efficiency (It determines whether the mining is successful and how much rewards miners can earn from the mining) and BTC prices (the target for larger profits), it may take a long time for a Bitcoin miner to eventually profit from selling the Bitcoins the mining rig earned from mining, during which some risks are involved due to uncertainty about the future prices of Bitcoin. Assume the mining costs (mining efficiency and electricity cost) remain unchanged, the miner can mine for 3 months (N BTC earned). The miner is expected to get 40, 000 * N USDT based on the current market price of BTC at 40,000 USDT. But three months later, the market price of BTC could rise to 60, 000 USDT or fall to 20, 000 USDT. A price rise will bring more gains, while a price fall will halve the profits for the miner. Taking this into account, the miners will choose to short contracts at 40, 000 USDT as a hedge against the possible risks during the three months.

As a financial strategy and risk management technology, hedging can help investors maintain a stable value for their investments and limit risks to reduce their losses amid volatile market conditions. In the field of economics, hedging strategies are widely used when trading stocks, funds, foreign exchange, futures and other markets. With the rise of cryptocurrency trading, hedging strategies have also been adopted in crypto markets.

Hedging

To put it simply, hedging is the process where an investor hedges one investment by making an opposite trade with another investment that has negative correlations.

Correlations refer to the similar price movements two commodities share in their respective markets in terms of the relationship between supply and demand, namely that if the supply-demand relationship changes, the prices of the two commodities will also change in the same direction. Negative corrections are conditions based on which the two communities are traded in the opposite direction to ensure that the loss suffered in one trade will be offset by the profit earned from the other regardless of the specific direction. In order to balance the profits and losses, the size of the two trades should be determined based on the price change difference of the two commodities, so as to yield a hedging effect.

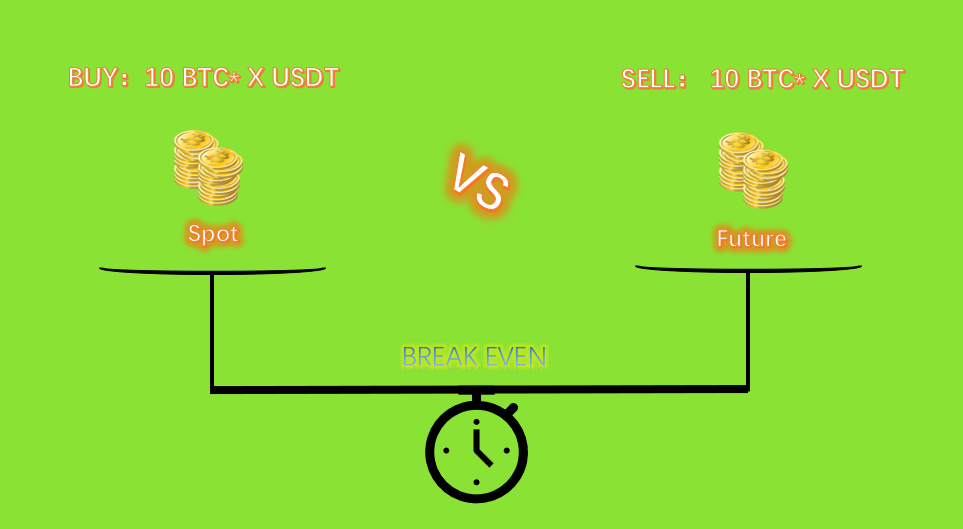

Take a hedge between the spot market and the futures market as an example. Investors can make a trade in the spot market while performing an offsetting trade in futures markets. For instance, considering a possible loss due to a price fall, an investor sells 10 BTC (BTC price is expected to fall) in the futures market while buying 10 BTC (BTC price is expected to rise) in the spot market, so as to hedge the risk of a BTC price decrease in the spot market. By doing so, if the BTC price rises as expected, the investor will make a profit from the spot market and suffer a loss in the futures market, and vice versa. With hedging, investors can always strike a balance between profit and loss to protect themselves from risks.

It’s worth noticing that we don’t take account of BTC prices in the above-mentioned cases and assume that the BTC trade size remains the same during hedging. However, as the price movements in the spot market are not always the same as those in the futures market and the trading costs in the two markets are different, investors need to execute hedging strategies in a flexible manner to make sure the size of the two trades is roughly the same.

In addition, due to different price performance in the futures and spot markets, especially when there are huge price differences between the two markets, the markets provide arbitrage opportunities. Traders who adopt hedging focus more on profits rather than hedging risks, which is what we know as cross-time arbitraging. Therefore, there are no differences between hedging and arbitrage from the perspective of trading. However, in essence, they still see some differences.

Hedge vs Arbitrage & Hedge vs Hedging

1. Hedge vs Arbitrage: There are no differences between hedge and arbitrage in terms of trading, as both of them adopt the form of two-way trading to hedge the risks in a unilateral trade (i.e., trade in one side, like investors need to face downward risks if they place a buy order). From this point of view, arbitrage is considered as a traditional hedging strategy. In essence, however, they have different ends. One is for profiting from price spread, while the other is for hedging risk to reduce losses. Plus, they are different in risk structure, namely hedgers need to bear system risks (risks of price changes) while arbitrageurs don’t.

2. Hedge vs Hedging: Functionally, both hedge and hedging can be used to hedge risks. The principle of hedging strategies is a hedge (Hedging is included in the definition of hedge). However, hedging puts emphasis on investment result, namely stabilizing returns by reserving the certainty in the investment. Hedge focuses on investment approaches, aiming to hedge risks by eliminating the uncertainty in the investment.

Common Hedging Strategies

| Buying hedge | Hedgers buy contracts to hedge upside risks |

| Selling hedge | Hedgers sell contracts to hedge downside risks |

| Risk hedge | Invest in the assets with negative earnings volatility correlations to the underlying asset |

| Futures hedge | hedging, calendar spread arbitrage, cross market arbitrage, inter-commodity Spread |

| Forex hedge | Hedging risks of one-sided trades by buying one currency and shorting another with roughly the same amount |

Pros and Cons of Hedge

Hedging strategies can help protect investors from various financial risks, including 1. commodity risks: risks caused by potential fluctuations in the value of agricultural products, metals and other commodities; 2. credit risks: The risks of the debtor failing to repay the loan; 3. currency risks: Potential gains or losses when investors convert one currency to another, or engage in overseas investments or international trades; 4. Interest rate risks: Risks of depreciation of the relative value of interest-bearing liabilities such as loans or bonds due to rising interest rates 5. volatility risks: changes in exchange rates, the price of underlying assets, and so on.

Hedging is an approach to balance risks with returns and is used to hedge risks. As risks and returns coexist, hedging is effectively used to reduce the uncertainty of the investment. In other words, hedging aims to prevent losses, rather than earn profits. Therefore, the reduction in risk provided by hedging also typically results in a reduction in potential profits.